Exploring the realm of Narayana Hrudayalaya Share Price: Is It a Safe Healthcare Investment?, this introductory segment delves into a captivating narrative, blending engaging insights with a touch of sophistication to captivate the audience right from the start.

The subsequent paragraph will offer detailed and concise information about the subject matter.

Overview of Narayana Hrudayalaya Share Price

Narayana Hrudayalaya is a prominent player in the healthcare sector, with its share price being closely monitored by investors. Let's delve into the current trends and factors influencing its share price.

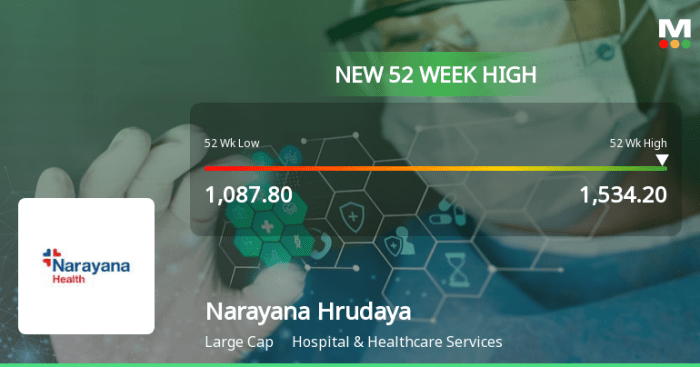

Current Trends in Narayana Hrudayalaya’s Share Price

- The share price of Narayana Hrudayalaya has been showing a steady increase over the past few months, reflecting positive investor sentiment.

- Recent market volatility has also impacted the share price, causing fluctuations in its value.

- Analysts predict a bullish trend for Narayana Hrudayalaya's share price in the upcoming quarters, based on its strong financial performance.

Historical Data on Narayana Hrudayalaya’s Share Price

- Over the years, Narayana Hrudayalaya's share price has witnessed both highs and lows, mirroring the overall performance of the company.

- Key events such as new partnerships, acquisitions, or regulatory changes have directly impacted the share price movement in the past.

- Long-term investors have seen significant returns on their investments in Narayana Hrudayalaya, highlighting its potential as a lucrative option.

Factors Influencing Narayana Hrudayalaya’s Share Price

- The overall performance of Narayana Hrudayalaya in terms of revenue growth, profitability, and market positioning plays a crucial role in determining its share price.

- Market dynamics, industry trends, and macroeconomic factors such as interest rates and inflation also impact the share price of Narayana Hrudayalaya.

- Investor sentiment, news flow, and analyst recommendations can create short-term fluctuations in the share price, highlighting the importance of staying informed.

Comparison with Competitors in the Healthcare Sector

- When compared to its competitors in the healthcare sector, Narayana Hrudayalaya's share price may exhibit unique trends and performance indicators.

- Factors such as market share, innovation pipeline, and regulatory environment can differentiate Narayana Hrudayalaya from its peers and influence its share price.

- Investors should conduct a thorough analysis of Narayana Hrudayalaya's competitive landscape to make informed investment decisions based on its share price performance.

Narayana Hrudayalaya’s Financial Performance

Narayana Hrudayalaya's financial performance is a key factor to consider when evaluating its potential as a healthcare investment. By examining the company's financial statements and key financial indicators, investors can gain insights into its overall financial health and stability.

Revenue Trends

- Over the past few years, Narayana Hrudayalaya has shown steady growth in revenue, driven by an increasing patient base and expansion of its healthcare services.

- The company's revenue growth rate can be compared to industry benchmarks to assess its competitiveness and market position.

Profit Margins

- Profit margins are crucial indicators of a company's profitability and efficiency in managing costs.

- Examining Narayana Hrudayalaya's profit margins can provide insights into its operational efficiency and financial performance compared to industry peers.

Debt Levels

- Monitoring the company's debt levels is essential to evaluate its financial leverage and risk exposure.

- High debt levels can impact Narayana Hrudayalaya's ability to invest in growth opportunities and withstand economic downturns.

Comparison with Industry Benchmarks

- Comparing Narayana Hrudayalaya's financial performance with industry benchmarks allows investors to assess its relative strength and weaknesses within the healthcare sector.

- By analyzing key financial metrics such as revenue growth, profit margins, and debt levels, investors can make informed decisions about the company's investment potential.

Healthcare Industry Analysis

The healthcare industry is a critical sector that plays a pivotal role in society, offering essential services to maintain public health and well-being. With advancements in technology and an increasing focus on preventive care, the healthcare industry is continuously evolving to meet the changing needs of patients worldwide.

Current Landscape and Growth Prospects

The healthcare industry is experiencing significant growth, driven by factors such as an aging population, increasing chronic diseases, and rising healthcare expenditures. With the rise of telemedicine and digital health solutions, the industry is embracing innovation to improve patient outcomes and enhance access to care

- Emergence of personalized medicine and precision healthcare

- Integration of artificial intelligence and data analytics in healthcare delivery

- Expansion of healthcare services in emerging markets

Key Trends and Challenges

Despite the promising growth prospects, the healthcare industry also faces several challenges that impact its operations and financial performance. From regulatory hurdles to rising costs of healthcare services, industry players must navigate a complex landscape to remain competitive and sustainable.

- Increasing regulatory scrutiny and compliance requirements

- Rising healthcare costs and affordability concerns

- Shift towards value-based care and population health management

Regulatory Changes and Healthcare Policies

Regulatory changes and healthcare policies have a direct impact on healthcare companies, influencing their operations, revenue streams, and overall market performance. Changes in reimbursement policies, healthcare legislation, and quality standards can significantly affect Narayana Hrudayalaya's share price and financial outlook.

- Impact of government initiatives on healthcare infrastructure development

- Changes in insurance coverage and reimbursement models

- Compliance with data privacy and security regulations

Opportunities for Growth and Expansion

Despite the challenges, the healthcare industry presents various opportunities for growth and expansion, especially for companies like Narayana Hrudayalaya that are focused on delivering quality healthcare services and driving innovation. By tapping into new markets, investing in technology, and enhancing patient engagement, healthcare providers can position themselves for long-term success.

- Expansion of telehealth services and remote patient monitoring

- Investment in healthcare IT infrastructure and digital health solutions

- Collaboration with research institutions and academic centers for clinical advancements

Investment Considerations

When considering investing in Narayana Hrudayalaya, it is crucial to evaluate both the risks and potential returns associated with this healthcare investment. Understanding the long-term outlook for the company, as well as qualitative factors such as management quality and competitive advantages, will help investors make informed decisions.

Risks and Potential Returns

- Narayana Hrudayalaya operates in a competitive industry where changes in regulations, technological advancements, and economic conditions can impact its performance.

- Investors should consider the company's financial stability, growth prospects, and market position to assess potential returns.

- Fluctuations in healthcare demand, pricing pressures, and operational challenges could pose risks to the investment.

Long-Term Outlook

- Narayana Hrudayalaya has shown steady growth in recent years, expanding its healthcare services and reaching a larger patient base.

- The company's focus on innovation, quality patient care, and strategic partnerships could contribute to its long-term success in the healthcare industry.

- Investors should consider the company's ability to adapt to changing market dynamics and emerging trends to assess its long-term outlook.

Management Quality and Competitive Advantages

- Narayana Hrudayalaya's management team plays a crucial role in the company's strategic direction and operational efficiency.

- The company's competitive advantages, such as its strong brand reputation, specialized services, and cost-effective healthcare solutions, can differentiate it from competitors.

- Investors should analyze the management quality and competitive strengths of Narayana Hrudayalaya to gauge its sustainability and growth potential.

Recommendations for Investors

- Before investing in Narayana Hrudayalaya, investors should conduct thorough research, including analyzing financial reports, industry trends, and competitor performance.

- Diversifying investment portfolios and considering the company's growth prospects and risk factors can help mitigate potential losses.

- Consulting with financial advisors or experts in the healthcare industry can provide valuable insights and guidance for making informed investment decisions.

Last Recap

Concluding this discourse with a compelling summary, encapsulating key points in a manner that leaves a lasting impact on the reader.

FAQ Resource

Is Narayana Hrudayalaya a good investment for the long term?

Answer: This depends on various factors such as market conditions, company performance, and individual investment goals. It's crucial to conduct thorough research and seek professional advice before making any investment decisions.

How does Narayana Hrudayalaya's financial performance compare to its competitors?

Answer: Narayana Hrudayalaya's financial performance can be evaluated by comparing key metrics such as revenue, profit margins, and debt levels with those of its competitors in the healthcare sector. This comparative analysis can provide insights into the company's competitive position within the industry.

What are the key regulatory risks associated with investing in Narayana Hrudayalaya?

Answer: Regulatory risks in the healthcare sector can stem from changes in government policies, healthcare regulations, or insurance reimbursement rates. Investors should stay informed about such regulatory developments that could impact Narayana Hrudayalaya's operations and financial performance.