Starting off with how healthcare stocks like Narayana are transforming investment portfolios, this initial paragraph aims to grab the readers' attention and provide a glimpse into the discussion that follows.

Following this, we delve into the specifics of the topic, shedding light on the various aspects that make healthcare stocks a lucrative choice for investors.

How Healthcare Stocks Impact Investment Portfolios

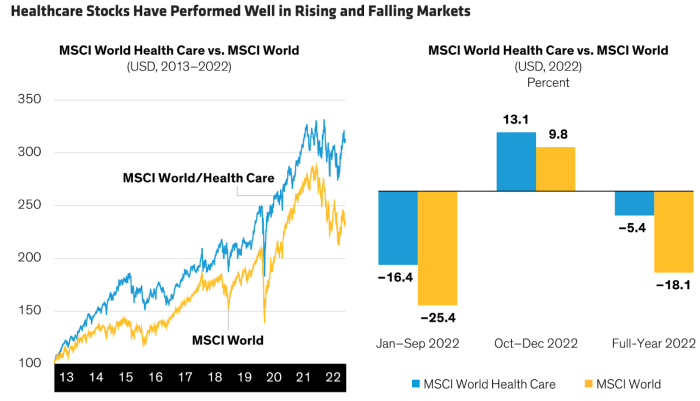

Investing in healthcare stocks like Narayana can play a crucial role in shaping an investment portfolio. These stocks offer a unique opportunity for diversification, as they are not directly tied to the performance of traditional sectors like technology or finance.

Significance of Healthcare Stocks in Diversifying Portfolios

Healthcare stocks provide investors with exposure to a sector that is relatively insulated from economic downturns. Medical services, pharmaceuticals, and biotechnology companies tend to have consistent demand regardless of market conditions. By adding healthcare stocks to a portfolio, investors can reduce overall risk through diversification.

- For example, during the COVID-19 pandemic, healthcare stocks remained relatively stable compared to other sectors that experienced significant volatility.

- Investing in a mix of healthcare companies, such as hospitals, drug manufacturers, and medical device makers, can further enhance portfolio diversification.

Potential Risks and Rewards of Including Healthcare Stocks

Including healthcare stocks in an investment portfolio comes with its own set of risks and rewards. While healthcare companies can offer long-term growth potential, they are also subject to regulatory changes, patent expirations, and clinical trial outcomes that can impact stock prices.

- One of the rewards of investing in healthcare stocks is the potential for substantial returns, especially in innovative companies that develop breakthrough treatments or technologies.

- On the other hand, risks such as regulatory hurdles, litigation, or competition from generic drugs can lead to sudden declines in stock value.

Narayana and its Role in Healthcare Investment

Narayana Health, founded in 2000 by Dr. Devi Shetty, has become a prominent player in the healthcare sector, particularly in India. The company has grown rapidly over the years, expanding its services to include a wide range of medical specialties and treatments.

Background of Narayana and its Growth in the Healthcare Sector

Narayana Health started as a single hospital in Bangalore and has now evolved into a network of hospitals across India and even internationally. The company is known for its focus on providing high-quality, affordable healthcare to a wide range of patients, including those from lower-income backgrounds.

This commitment to accessibility has helped Narayana Health gain a strong reputation in the healthcare industry.

Performance of Narayana Stocks and Influence on Investment Decisions

The performance of Narayana stocks in the market has been quite impressive, attracting the attention of investors looking to capitalize on the growth of the healthcare sector. As the company continues to expand its reach and enhance its services, the value of its stocks has seen significant increases, making it an attractive option for investment portfolios.

The success of Narayana stocks has influenced many investors to include healthcare stocks in their portfolios to diversify and potentially benefit from the sector's growth.

Comparison of Narayana with Other Healthcare Companies in Terms of Investment Appeal

When compared to other healthcare companies, Narayana stands out for its unique approach to providing affordable healthcare without compromising on quality. This focus on accessibility has not only contributed to the company's success but has also made it a compelling investment opportunity for those looking to support a socially responsible company.

In terms of investment appeal, Narayana's growth potential and commitment to affordable healthcare make it a competitive choice in the healthcare sector.

Trends in Healthcare Stock Investment

Healthcare stock investments have been experiencing significant trends that are reshaping investment portfolios across the market. Investors are increasingly turning to healthcare stocks due to a variety of factors driving their popularity and potential for growth. Technological advancements in healthcare are also playing a crucial role in influencing stock market investments.

Increased Focus on Biotech and Pharma Stocks

- Biotech and pharmaceutical companies are attracting a large amount of investor interest due to their potential for groundbreaking innovations and new drug developments.

- The continuous research and development efforts in these sectors contribute to the excitement surrounding biotech and pharma stocks, making them appealing options for investors looking for high growth opportunities.

Rise of Telemedicine and Digital Health Stocks

- Telemedicine and digital health companies have seen a surge in investment as the pandemic highlighted the importance of remote healthcare services.

- The convenience and efficiency of telemedicine offerings have made these stocks increasingly attractive to investors seeking exposure to the digital transformation of healthcare.

Impact of Healthcare Technology Innovations

- Advancements in healthcare technology, such as AI-driven diagnostics, robotic surgeries, and personalized medicine, are revolutionizing the industry and driving investor interest in related stocks.

- Companies at the forefront of developing and implementing these technologies are often viewed as having significant growth potential, leading to increased investment in the healthcare technology sector.

Strategies for Investing in Healthcare Stocks like Narayana

Investing in healthcare stocks like Narayana can be a lucrative endeavor, but it requires a strategic approach to navigate the market effectively. Here are some tips and strategies to consider when investing in healthcare stocks:

Research and Due Diligence

Before investing in any healthcare stock, it is crucial to conduct thorough research and due diligence. This includes analyzing the company's financial health, growth potential, market position, and competitive landscape. Understanding the regulatory environment and any upcoming developments in the healthcare industry can also help you make informed investment decisions.

Diversification

Diversification is key when investing in healthcare stocks. By spreading your investments across different companies within the healthcare sector, you can mitigate risks associated with individual stocks. Consider investing in a mix of pharmaceutical companies, biotech firms, healthcare providers, and medical technology companies to build a well-rounded healthcare stock portfolio.

Long-Term Focus

Healthcare stocks can be volatile, especially in response to regulatory changes, clinical trial results, or healthcare policy shifts. It is essential to have a long-term investment horizon when investing in healthcare stocks like Narayana. By focusing on the company's long-term growth potential and staying informed about industry trends, you can ride out short-term fluctuations and benefit from the sector's overall growth.

Stay Informed

Keeping up-to-date with the latest developments in the healthcare industry is crucial for successful investing. Subscribe to industry publications, follow healthcare analysts, and attend conferences or webinars to stay informed about emerging trends, breakthroughs in medical research, and regulatory changes that could impact healthcare stocks.

Staying informed will help you make well-informed investment decisions and capitalize on opportunities in the healthcare sector.

Concluding Remarks

Concluding our discussion on how healthcare stocks like Narayana are altering investment portfolios, we summarize the key points and leave readers with a lasting impression of the impact and potential of this sector.

FAQ Explained

How can healthcare stocks diversify an investment portfolio?

Investing in healthcare stocks can offer exposure to a sector known for its resilience and long-term growth potential, thus providing diversification benefits to a portfolio.

What are the potential risks of including healthcare stocks in an investment portfolio?

Healthcare stocks can be sensitive to regulatory changes, clinical trial outcomes, and other sector-specific factors, adding volatility and risk to a portfolio.

How does Narayana compare to other healthcare companies in terms of investment appeal?

Narayana stands out for its innovative approach to healthcare delivery, cost-effective services, and strong growth trajectory, making it an appealing investment choice compared to its peers.

What are some strategies for effectively investing in healthcare stocks like Narayana?

Investors can consider strategies such as focusing on companies with strong fundamentals, staying informed about industry trends, and diversifying across subsectors within healthcare for a well-rounded investment approach.

How do technological advancements in healthcare impact stock market investments?

Technological advancements in healthcare can drive innovation, efficiency, and new revenue streams for companies in the sector, influencing their stock performance and creating opportunities for investors.