Analyzing the Future of Narayana Hrudayalaya Stock sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. Dive into the world of stock analysis with a focus on Narayana Hrudayalaya, a company with a fascinating history and promising future.

In this detailed exploration, we will delve into the current position of Narayana Hrudayalaya in the stock market, identify key factors that influence its stock price, evaluate its financial performance, and explore growth prospects and expansion strategies. Get ready for an in-depth look at the future trajectory of this healthcare stock.

Overview of Narayana Hrudayalaya Stock

Narayana Hrudayalaya is a leading healthcare provider in India, specializing in cardiac care. Founded in 2000 by Dr. Devi Shetty, the hospital chain has expanded rapidly and gained a reputation for providing high-quality medical services at affordable prices.

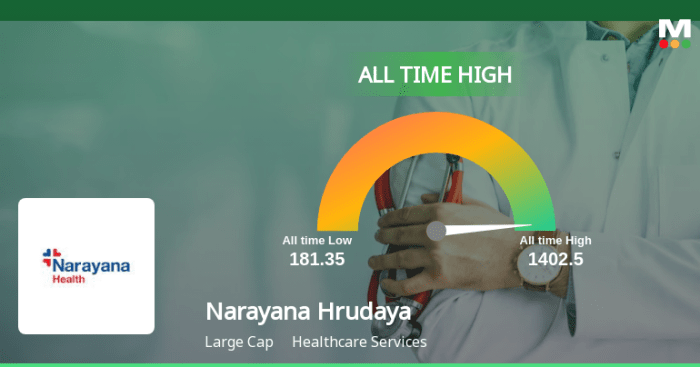

Currently, Narayana Hrudayalaya is listed on the Indian stock exchanges and has shown steady growth in the stock market. The company's financial performance and strategic expansion plans have attracted investors looking for opportunities in the healthcare sector.

Brief History of Narayana Hrudayalaya

Narayana Hrudayalaya was established with the vision of making quality healthcare accessible to all sections of society. Dr. Devi Shetty's innovative approach to healthcare delivery and cost-effective practices have set the hospital chain apart in the industry.

Significance of Analyzing the Future Prospects of Narayana Hrudayalaya Stock

As the healthcare sector continues to evolve, analyzing the future prospects of Narayana Hrudayalaya stock is crucial for investors. Understanding the company's growth potential, competitive positioning, and market trends can help investors make informed decisions and capitalize on opportunities in the stock market.

Factors Influencing Narayana Hrudayalaya Stock

When analyzing the future performance of Narayana Hrudayalaya stock, it is important to consider several key factors that can influence its stock price.

Industry Trends Impact

- The healthcare industry trends play a significant role in determining the stock performance of Narayana Hrudayalaya. Any advancements or setbacks in the healthcare sector can directly impact the company's financial results.

- Changes in government regulations related to healthcare services can also affect the stock price of Narayana Hrudayalaya. Compliance with new laws or policies may require additional investments or changes in operations, impacting the bottom line.

- Increasing competition in the healthcare industry can put pressure on Narayana Hrudayalaya to innovate and differentiate its services, which can influence investor sentiment and stock valuation.

Recent News and Events

- Any significant news related to Narayana Hrudayalaya, such as new partnerships, acquisitions, or expansions, can have a direct impact on the stock price. Positive developments may attract more investors, leading to a rise in the stock value.

- On the other hand, negative news like legal issues, lawsuits, or financial challenges can cause a decline in the stock price as investors lose confidence in the company's ability to generate returns.

- Economic factors such as changes in interest rates, inflation, or overall market conditions can also influence the stock performance of Narayana Hrudayalaya, as they do for most publicly traded companies.

Financial Performance Evaluation

In analyzing the financial performance of Narayana Hrudayalaya, we can gain valuable insights into the company's overall health and potential for growth. By examining the financial statements and comparing key ratios with industry benchmarks, we can forecast the future trajectory of the stock.

Financial Statements Analysis

Financial statements such as the income statement, balance sheet, and cash flow statement provide a comprehensive overview of Narayana Hrudayalaya's financial performance. By analyzing these statements, investors can assess the company's profitability, liquidity, and solvency. It is crucial to look at metrics like revenue growth, net income, operating cash flow, and debt levels to gauge the company's financial stability.

Comparison with Industry Benchmarks

Comparing Narayana Hrudayalaya's financial ratios with industry benchmarks can help investors understand how the company stacks up against its competitors. Key ratios to consider include the price-to-earnings ratio (P/E), return on equity (ROE), and debt-to-equity ratio. A higher P/E ratio may indicate that the stock is overvalued, while a lower ROE could suggest inefficiency in utilizing shareholders' equity.

By analyzing these ratios, investors can make informed decisions about the stock's potential for growth.

Interpreting Recent Financial Data

Recent financial data or reports released by Narayana Hrudayalaya can provide valuable insights into the company's current performance and future prospects. Factors such as new business initiatives, cost-saving measures, or changes in market conditions can impact the stock's trajectory. By interpreting this data and considering external factors, investors can forecast the future stock price movement and make informed investment decisions.

Growth Prospects and Expansion Strategies

As Narayana Hrudayalaya continues to establish itself as a leading player in the healthcare sector, let's delve into the growth opportunities and expansion strategies that could shape its future.

Expansion in Tier 2 and Tier 3 Cities

Narayana Hrudayalaya has been focusing on expanding its presence in Tier 2 and Tier 3 cities, tapping into the growing demand for quality healthcare services in these areas. By setting up hospitals and clinics in underserved regions, the company can reach a larger patient base and drive revenue growth.

International Expansion

The company has also been eyeing international markets for expansion. By establishing partnerships or acquiring existing healthcare facilities in countries with a growing medical tourism industry, Narayana Hrudayalaya can leverage its expertise and brand to attract patients from around the world.

Technology Integration

Narayana Hrudayalaya has been investing in cutting-edge technology to enhance patient care and operational efficiency. By incorporating telemedicine services, digital health platforms, and AI-driven solutions, the company can improve its service offerings and differentiate itself in a competitive market.

Summary

As we wrap up our analysis of the future of Narayana Hrudayalaya Stock, it's clear that the company's potential for growth and success in the healthcare sector is significant. By examining its history, financial performance, and expansion strategies, investors can gain valuable insights into the stock's future prospects.

Stay tuned for more updates on this compelling stock story.

Helpful Answers

What is the history of Narayana Hrudayalaya?

Narayana Hrudayalaya was founded in XXXX and has since become a prominent player in the healthcare industry.

How does industry trends impact the future of Narayana Hrudayalaya stock?

Industry trends can significantly influence the stock price of Narayana Hrudayalaya, reflecting shifts in market demand and competition.

What factors should investors consider when analyzing the financial performance of Narayana Hrudayalaya?

Investors should examine key financial ratios, revenue growth, and profitability trends to assess the company's financial health.

Are there any upcoming projects or partnerships that could impact the growth of Narayana Hrudayalaya?

Narayana Hrudayalaya's expansion strategies include upcoming projects and partnerships that have the potential to drive growth in the future.