Is General Motors Stock Undervalued in 2025? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve deeper into the key factors influencing General Motors stock value, the historical performance, future growth potential, and analyst recommendations and forecasts, a comprehensive picture of the stock's valuation in 2025 begins to emerge.

Factors Influencing General Motors Stock Value

General Motors stock value is influenced by a variety of factors, including key financial metrics, market trends, and external factors. Understanding these elements is crucial for investors looking to assess the potential value of GM stock.

Key Financial Metrics Affecting Stock Valuation

- Revenue: General Motors' revenue growth is a key indicator of the company's financial health and potential stock value.

- Profit Margin: The profit margin reflects the efficiency of GM's operations and its ability to generate profits from sales.

- Free Cash Flow: Free cash flow represents the cash available to GM after accounting for capital expenditures, a crucial metric for evaluating financial stability.

- Debt-to-Equity Ratio: This ratio indicates the level of debt financing relative to equity, providing insights into GM's financial leverage.

Market Trends Impacting General Motors Stock Price

- Electric Vehicles (EVs) Demand: The increasing demand for EVs can positively impact GM's stock price as the company expands its electric vehicle lineup.

- Competitive Landscape: Market competition, especially from other automakers and tech companies, can affect GM's stock performance.

- Interest Rates: Changes in interest rates can influence consumer spending on automobiles, impacting GM's sales and stock value.

External Factors Influencing Stock Valuation

- Regulatory Environment: Government regulations on emissions, safety standards, and trade policies can impact GM's operations and stock value.

- Global Economic Conditions: Economic factors such as GDP growth, inflation rates, and geopolitical events can affect GM's stock performance.

- Pandemic Impact: Events like the COVID-19 pandemic can disrupt supply chains, production, and consumer demand, impacting GM's stock price.

General Motors Stock Performance History

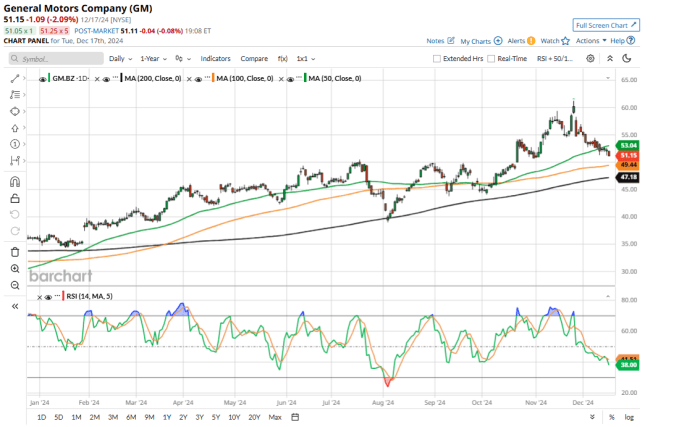

In recent years, General Motors' stock price has shown fluctuations influenced by various factors such as market trends, company performance, and industry competition.

Comparison with Industry Competitors

- General Motors' stock performance has been relatively stable compared to industry competitors like Ford and Tesla.

- While Tesla has shown rapid growth in stock value, General Motors has maintained a more steady trajectory.

- Ford, on the other hand, has faced challenges that have impacted its stock value, leading to fluctuations in comparison to General Motors.

Analysis of Historical Data

- By analyzing historical data, patterns in General Motors' stock value changes can be observed.

- Factors such as new product launches, market demand, economic conditions, and company performance have played a significant role in shaping these patterns.

- Studying the historical data can provide insights into potential future trends and help investors make informed decisions regarding General Motors' stock.

Future Growth Potential of General Motors

General Motors has Artikeld ambitious expansion plans that could significantly impact its stock valuation in the coming years. The company's focus on innovation and technology is key to driving future growth and maintaining a competitive edge in the rapidly evolving automotive industry.

Expansion Plans

- General Motors is investing heavily in electric vehicles (EVs) and autonomous driving technologies, aiming to lead the market in these areas.

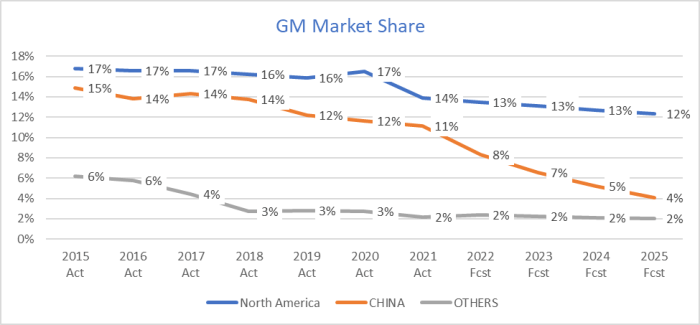

- The company is expanding its presence in emerging markets such as China and India, tapping into new consumer bases and increasing its global market share.

- Strategic partnerships and collaborations with tech companies and other industry players are expected to fuel further growth opportunities for General Motors.

Innovative Technologies

- General Motors' development of next-generation batteries for EVs and advancements in AI for autonomous vehicles are poised to revolutionize the automotive sector.

- The introduction of connected car technologies and digital services is enhancing the overall customer experience and creating new revenue streams for the company.

- Exploration of alternative fuel sources and sustainable practices are aligning General Motors with the growing demand for eco-friendly transportation solutions.

Potential Risks

- Market volatility and economic uncertainties could impact consumer demand for vehicles, affecting General Motors' sales and profitability.

- Regulatory changes and government policies related to emissions standards and trade agreements may pose challenges for the company's operations and expansion initiatives.

- Competition from other automakers and disruptive new entrants in the industry could threaten General Motors' market position and growth prospects.

Analyst Recommendations and Forecasts

In the world of stock markets, analyst recommendations and forecasts play a crucial role in shaping investors' perceptions and decisions. Let's delve into recent reports on General Motors stock and explore how these forecasts may impact the stock's value.

Analyst Reports on General Motors Stock

Analysts have been closely monitoring General Motors stock, with several recent reports providing insights into its future performance. One prominent analyst report suggests that General Motors is undervalued and has significant growth potential due to its focus on electric vehicles and autonomous driving technology.

This positive outlook has garnered attention from investors looking for long-term growth opportunities in the automotive sector.Another report highlights the impact of macroeconomic factors such as interest rates and consumer spending on General Motors stock. Analysts predict that any changes in these external factors could influence the stock's value in the coming years.

Additionally, geopolitical events and regulatory changes are also cited as potential drivers of General Motors stock performance.

Comparison of Analyst Views

While some analysts are bullish on General Motors stock, others maintain a more cautious stance, citing concerns about competition in the electric vehicle market and supply chain disruptions. These varying viewpoints create a dynamic landscape for investors, prompting them to carefully consider different perspectives before making investment decisions.Overall, analyst recommendations and forecasts serve as valuable tools for investors seeking to navigate the complex world of stock markets.

By staying informed about the latest reports and understanding the rationale behind analyst views, investors can make more informed decisions regarding General Motors stock.

Closing Summary

In conclusion, the evaluation of General Motors stock in 2025 unveils a complex interplay of financial metrics, market trends, growth potential, and expert forecasts. Whether the stock is truly undervalued remains a question that investors and analysts will continue to ponder, shaping the narrative of General Motors' trajectory in the years to come.

Essential Questionnaire

What are the key financial metrics affecting General Motors stock valuation?

Key financial metrics affecting General Motors stock valuation include revenue growth, profit margins, earnings per share, and return on equity.

How does General Motors stock performance compare with its industry competitors?

General Motors stock performance can be compared with industry competitors by analyzing metrics like market share, sales growth, and profitability ratios.

What innovative technologies or products could drive future growth for General Motors?

Innovative technologies like electric vehicles, autonomous driving systems, and connectivity features could drive future growth for General Motors.

What are the potential risks that may hinder General Motors' growth and stock value?

Potential risks that may hinder General Motors' growth and stock value include competition, economic downturns, regulatory changes, and supply chain disruptions.

How do analyst forecasts impact the perception of General Motors stock value?

Analyst forecasts can impact the perception of General Motors stock value by influencing investor sentiment, trading volumes, and stock price movements.