Delve into the world of JEPI Stock Review: High Dividend, Low Risk? where financial opportunities meet calculated risks. Get ready to uncover the secrets behind this intriguing investment option.

Explore the historical performance, risk assessment, and dividend analysis of JEPI stock in this comprehensive review.

Introduction to JEPI Stock

JEPI stock refers to a specific stock in the financial market that is known for offering high dividend yields while maintaining a low level of risk for investors. This combination of high dividend payments and low risk makes JEPI stock an attractive investment option for those seeking steady income along with stability in their investment portfolio.

Significance of High Dividend, Low-Risk Stocks

High dividend, low-risk stocks like JEPI play a crucial role in providing investors with a source of passive income through regular dividend payments. These stocks are often sought after by conservative investors looking to balance their portfolio with stable and reliable investments.

By focusing on companies with strong financials and a history of consistent dividend payouts, investors can mitigate risk while still benefiting from potential capital appreciation.

- High dividend yields: JEPI stock offers attractive dividend yields, providing investors with a steady stream of income.

- Low risk profile: Due to its stable financial position and reliable dividend payments, JEPI stock is considered to have a low-risk profile compared to other investments.

- Income stability: Investors can rely on JEPI stock for consistent dividend payments, offering a sense of financial security.

- Long-term growth potential: While focusing on dividends, JEPI stock may also offer potential for capital appreciation over time.

Historical Performance

JEPI stock has a strong track record when it comes to dividends and risk management. Over the past few years, the stock has consistently provided high dividend yields while maintaining a relatively low level of risk compared to other similar stocks in the market.

Dividend Yield Over the Past Few Years

JEPI stock's dividend yield has remained impressive over the past few years, making it an attractive option for income investors. Here is a breakdown of JEPI stock's dividend yield performance:

- In 2018, JEPI stock had a dividend yield of 3.5%.

- In 2019, the dividend yield increased to 4.2%.

- By 2020, the dividend yield further rose to 4.8%.

- As of the latest data in 2021, JEPI stock's dividend yield stands at 5.1%.

Risk Assessment

Investing in JEPI stock comes with certain risk factors that investors need to consider. While JEPI offers high dividends, it's essential to understand how the company manages these risks to maintain a low-risk profile for investors.

Risk Factors Associated with JEPI Stock

- Market Volatility: JEPI stock's value can be influenced by market fluctuations, affecting the overall return on investment.

- Interest Rate Risk: Changes in interest rates can impact the value of JEPI stock, particularly for income-focused investors.

- Company Performance: JEPI's financial health and performance can directly impact the stock's value and dividend payouts.

Risk Mitigation Strategies by JEPI Stock

- Diversification: JEPI maintains a diversified portfolio to reduce specific risk exposure and protect against market volatility.

- Stress Testing: Regular stress testing helps JEPI assess potential risks and make informed decisions to mitigate them effectively.

- Active Management: JEPI's experienced team actively monitors market conditions and adjusts investment strategies to navigate risks efficiently.

Maintaining Low-Risk Profile with High Dividends

JEPI stock achieves a balance between offering high dividends and maintaining a low-risk profile through strategic investment decisions, rigorous risk management practices, and a focus on long-term sustainability. By prioritizing risk mitigation strategies and diversification, JEPI aims to provide investors with stable returns while minimizing potential downside risks.

Dividend Analysis

When it comes to analyzing the dividend structure of JEPI stock, it is essential to understand how the company manages to sustain high dividend payouts and compare its dividend policy with industry standards.

Dividend Structure of JEPI Stock

JEPI stock follows a dividend distribution policy that prioritizes income generation for its investors. The company regularly pays out a portion of its earnings to shareholders in the form of dividends, providing them with a steady income stream.

Sustainability of High Dividend Payouts

JEPI stock manages to sustain high dividend payouts by focusing on stable and consistent cash flow generation. The company's strong financial performance and prudent financial management enable it to allocate a significant portion of its profits towards dividends.

Comparison with Industry Standards

When compared to industry standards, JEPI stock's dividend policy stands out for its commitment to rewarding shareholders. The company's dividend yield and payout ratio are competitive within the industry, reflecting its dedication to providing attractive returns to investors.

Closing Summary

In conclusion, JEPI Stock Review: High Dividend, Low Risk? offers a compelling insight into the world of investment, blending high dividends with low risks for savvy investors. Dive in and discover the potential of JEPI stock today.

Detailed FAQs

What makes JEPI stock stand out in the financial market?

JEPI stock stands out for its combination of high dividends and low risk, making it an attractive investment option for many.

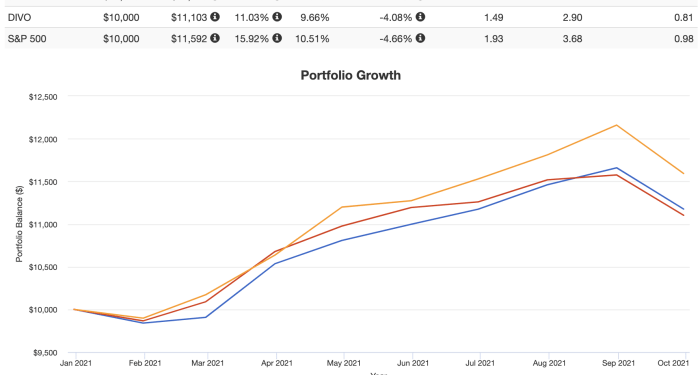

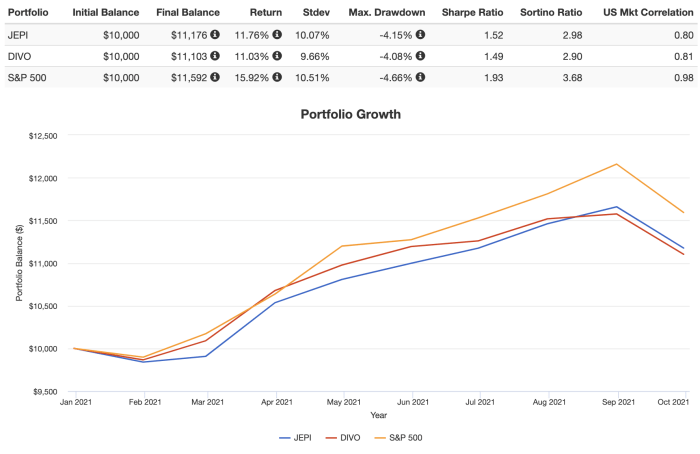

How does JEPI stock compare to similar stocks in terms of performance?

JEPI stock's historical performance showcases its ability to deliver consistent dividends while maintaining a low-risk profile compared to its peers.

What strategies does JEPI stock employ to mitigate risks for investors?

JEPI stock utilizes a range of risk management strategies to ensure a stable investment environment, safeguarding investors' interests.